Dichotomy Between A Healthy Economy and Low Consumer Confidence

The American economy has been healthy, with key indicators pointing to stability and growth. The fear of an imminent recession has ebbed, with many experts acknowledging that the economy is not only growing but doing so at a reassuring pace. This growth is underpinned by a series of positive developments such as falling inflation rates.

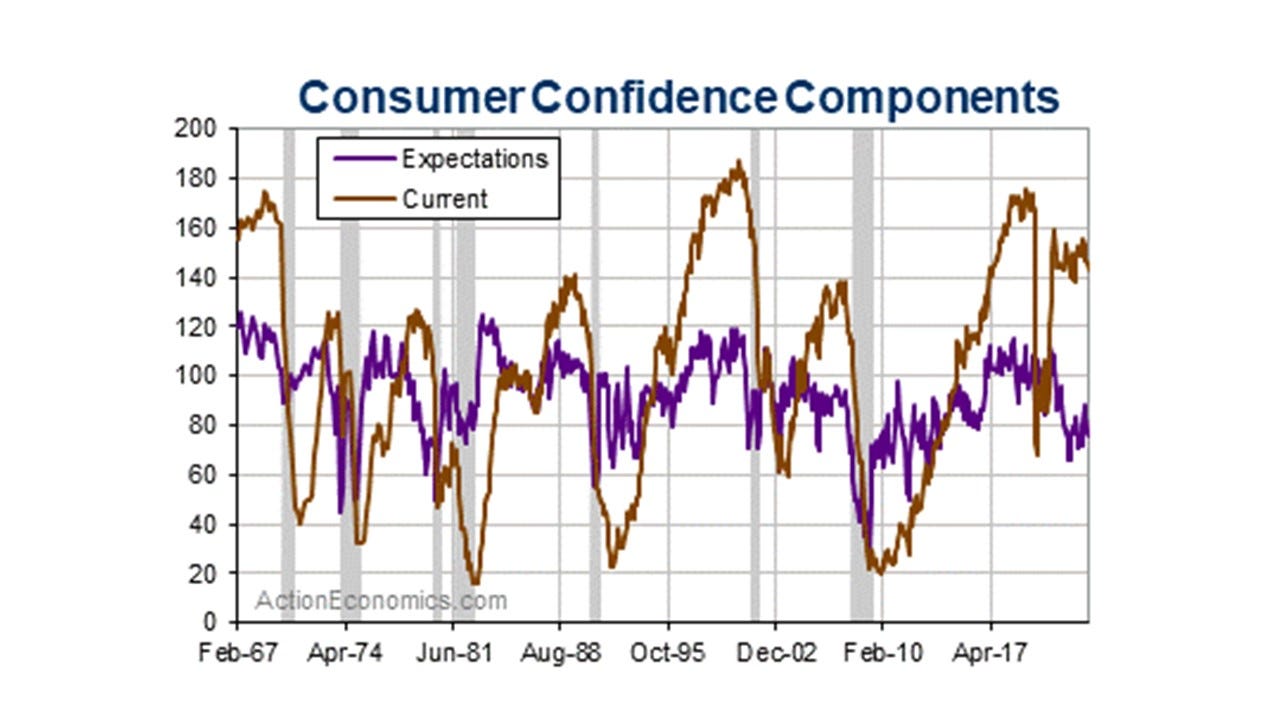

Despite the headline figures, many Americans do not feel the benefits of this growth in their wallets. Consumer confidence, especially for the future, is low.

Consumer confidence is important for consumer spending and business investment. High consumer confidence often leads to increased consumer spending, as individuals are more likely to make significant purchases and invest in higher-priced items. When consumers are confident, businesses tend to experience higher sales and profits. This can lead to increased business investment as companies expand operations and invest in new projects in anticipation of continued demand.

Consumer confidence influences the stock market. If consumers are optimistic, they are more likely to invest in stocks, which can drive up stock prices. Conversely, low consumer confidence may lead to reduced investment and falling stock prices.

How do we explain the dichotomy between the economy and the uneasiness among consumers?

Inflation is a major reason. The cost of living, particularly the prices of essential goods and services compared to the pre-pandemic level, has continued to climb, outpacing wage growth for many. Government data show that the overall CPI rose 20 percent between October 2019 to October 2023. During that period, food prices rose 25 percent, energy 33 percent and new cars 26 percent.

Nowhere is the impact of inflation felt more acutely than in the housing market. The cost of shelter, including rents, rose 20 percent during the same period. Homeownership, long considered a keystone of the American dream and an essential marker of middle-class status, has become increasingly elusive. It's not just about having a roof over one's head; homeownership is deeply interwoven with American identity and aspirations—determining social status, influencing family planning, and serving as the most significant wealth-building tool for middle-income earners.

But with the double whammy of rising house prices and mortgage rates, this dream is fading for many. The housing market has seen dramatic increases in value, which, while beneficial for current homeowners, presents a barrier to entry for first-time buyers and those without substantial equity. This has profound implications for generational wealth distribution and economic mobility, suggesting that younger generations, particularly Gen X, Z, and millennials, may end up less well-off than their predecessors, a stark reversal of the traditional American narrative of each generation surpassing the last.

The economic milestones that marked the journey to prosperity for previous generations seem increasingly out of reach for today's young adults. The cost of education, the affordability of homeownership, and the ability to save for retirement are all being squeezed by the current economic pressures.

This economic strain disproportionately affects those at the lower end of the income spectrum. Moreover, it erodes the sense of economic security that is foundational to consumer confidence, leading to a cautious, if not outright pessimistic, outlook on the economy.

In conclusion, the gap between the broader economic recovery and the feeling of American consumers must be narrowed to enjoy a durable economic recovery.