Fourthe Industrial Revolution Driving Stock Market

There were exactly 100 trading days before Memorial Day. Historically, the S&P 500 has risen by about 25% for the full year whenever it has gained 10% or more during the first 100 days of the year. This raises the question: Is this just a coincidence, or are there strong reasons to expect a continued rally in the stock market?

There are three compelling reasons to believe an upward trend in the stock market will continue for the remainder of the year.

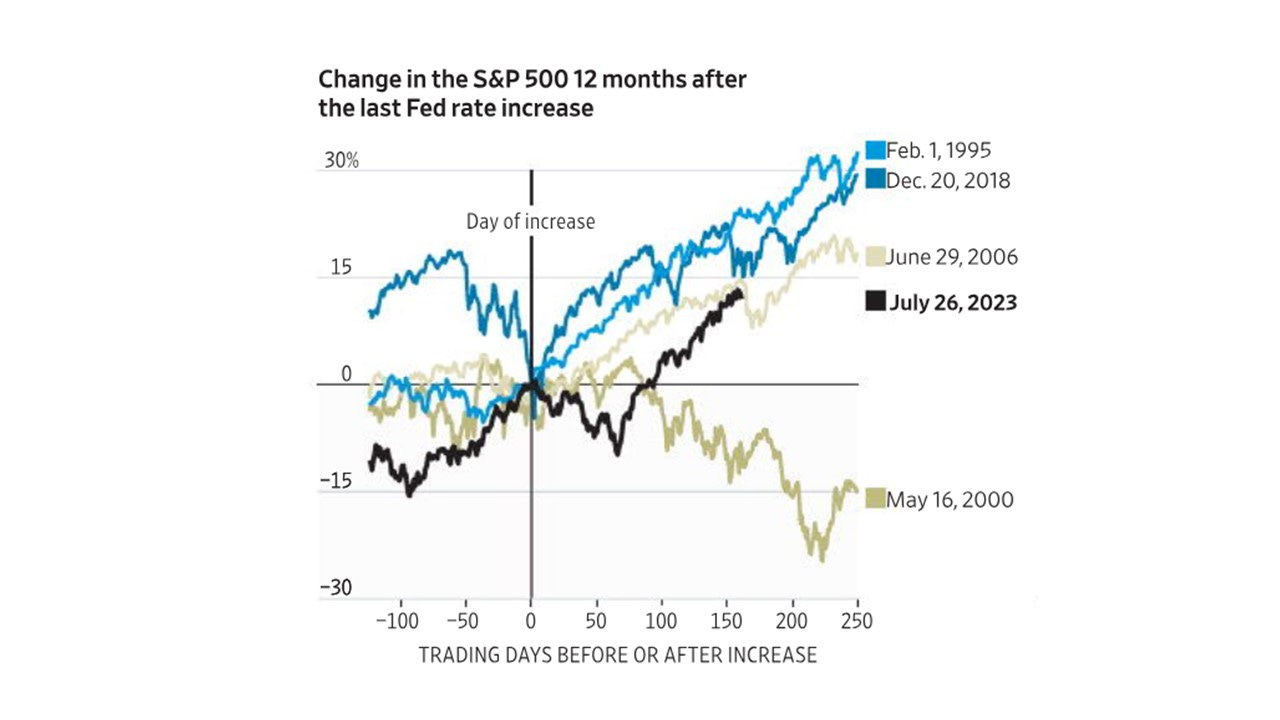

First, historically, the peak of the interest rate cycle set by the Federal Reserve has been a strong indicator of a rising stock market. When the Federal Reserve signals that it has reached or is nearing the end of its tightening cycle, it reduces uncertainty about future the interest rate. Investors prefer certainty and knowing that rates are unlikely to rise further helps them make more informed investment decisions. This reduction in uncertainty can boost investor confidence and lead to increased buying in the stock market. In addition, stock prices are influenced by the discount rate applied to future cash flows. When interest rates peak and are expected to fall, the discount rate used for valuing stocks decreases, making future cash flows more valuable leading to higher stock valuations.

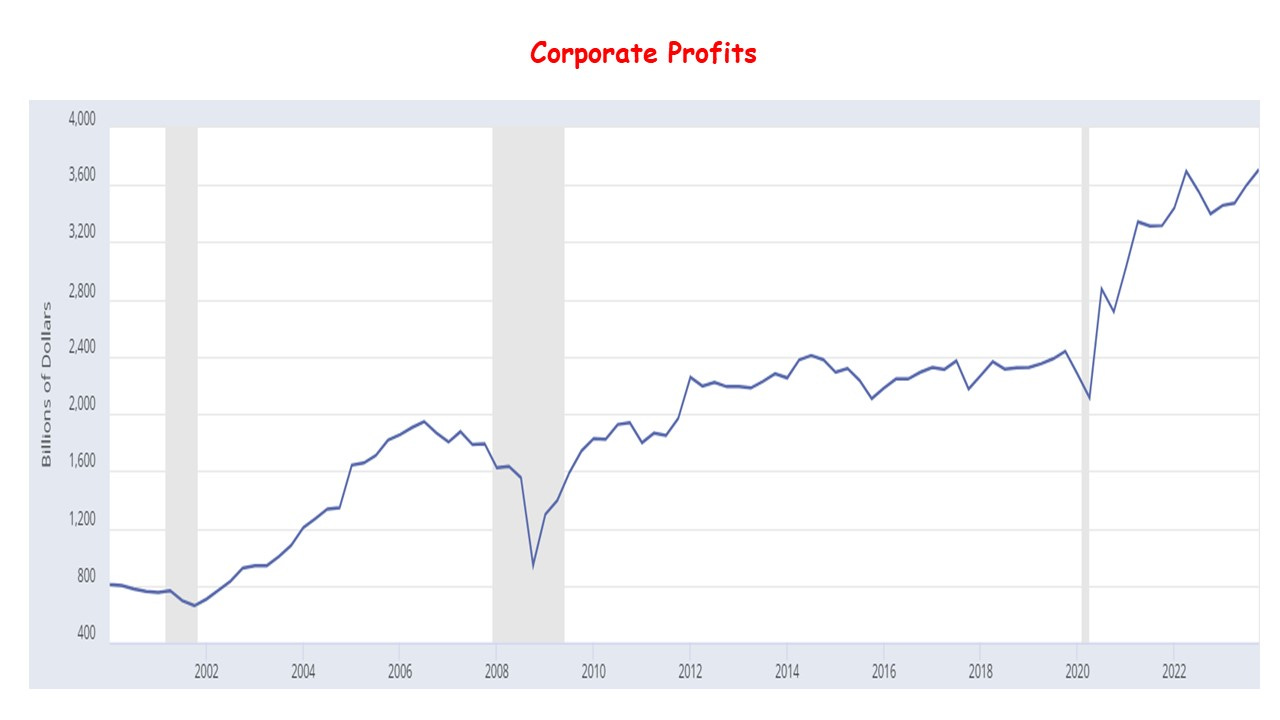

Second, healthy corporate profits are driving the stock market upward. In the fourth quarter of 2023, corporate profits reached a record high of $2.8 trillion, a 12% annualized increase from the previous quarter. The upward trend in earnings towards the end of 2023 set a strong foundation for the anticipated robust growth in 2024, driven by continued consumer spending and economic strength. The consensus forecast for 2024 is 11.8%, which is above the trailing 10-year average annual earnings growth rate of 8.4%. Not only are overall corporate profits rising, but these increases have also broadened beyond the tech sector.

Finally, the most significant reason for the stock market's upward trend is the transformative impact of artificial intelligence (AI), machine learning, and advanced computing technologies, which Jensen Huang, CEO of Nvidia, refers to as the "Fourth Industrial Revolution." These technologies are becoming integral to various industries, enhancing productivity, efficiency, and innovation. High-performance computing, including GPUs and data centers, is driving breakthroughs in scientific research, autonomous vehicles, healthcare, and more. AI and robotics are automating tasks across manufacturing, logistics, and services, leading to significant changes in labor markets. The Internet of Things (IoT) and 5G connectivity are enabling smarter cities, homes, and infrastructure. Companies are leveraging data analytics to make informed decisions, optimize operations, and create personalized experiences for consumers.

As the “Fourth Industrial Revolution” continues, investment may shift from traditional sectors to tech and innovation-driven companies, affecting sector performance across the stock market. New market leaders will emerge, reshaping the composition of major indices. From an economic standpoint, increased productivity from technological advancements can boost economic growth, positively impacting the stock market. While some jobs may be displaced, new opportunities in tech and related fields will multiply, boosting the economy and the market.

In conclusion, the historical peak in the interest rate cycle, healthy corporate profits, and the transformative impact of AI and advanced computing technologies collectively provide strong reasons to expect a continued upward trend in the stock market for the remainder of the year. These factors contribute to a more optimistic outlook, suggesting that the market's recent gains may be indicative of a sustained rally.