Despite the increase in the 10-year Treasury yield, the stock market continued to rise—until recently. As long as the economy was robust generating strong corporate earnings, higher interest rates weren't a concern for stocks. In the meantime, the stock market became somewhat overvalued. However, after a noticeable slowdown in economic growth during the first quarter, concerns about potential stagflation and declining profits have emerged. Adding to these worries, the Federal Reserve has postponed any reduction in interest rates, with some officials questioning whether their monetary policy has been less restrictive than previously thought.

This scenario calls for a thorough assessment of the economic dynamics at play.

Consumer spending, which accounts for over two-thirds of the U.S. economy, has been the workhorse of the economy, bolstered by a labor market that has seen its 39th consecutive month of growth and maintains a jobless rate near a 50-year low. Although there are signs of a cooling labor market, such as a declining quit rate and a slight rise in layoffs, these have not significantly impacted consumer spending. However, job growth has been concentrated primarily in sectors like healthcare, leisure and hospitality, social assistance, and government-funded construction.

Wages have continued to rise faster than prices, boosting consumer purchasing power. The Federal Reserve Bank of Atlanta reports a 4.7% increase in wages over the past year. Additionally, increases in house and stock prices have driven a rise in household wealth, which surged by $11.6 trillion in 2023 to a total of $156.2 trillion, according to government data.

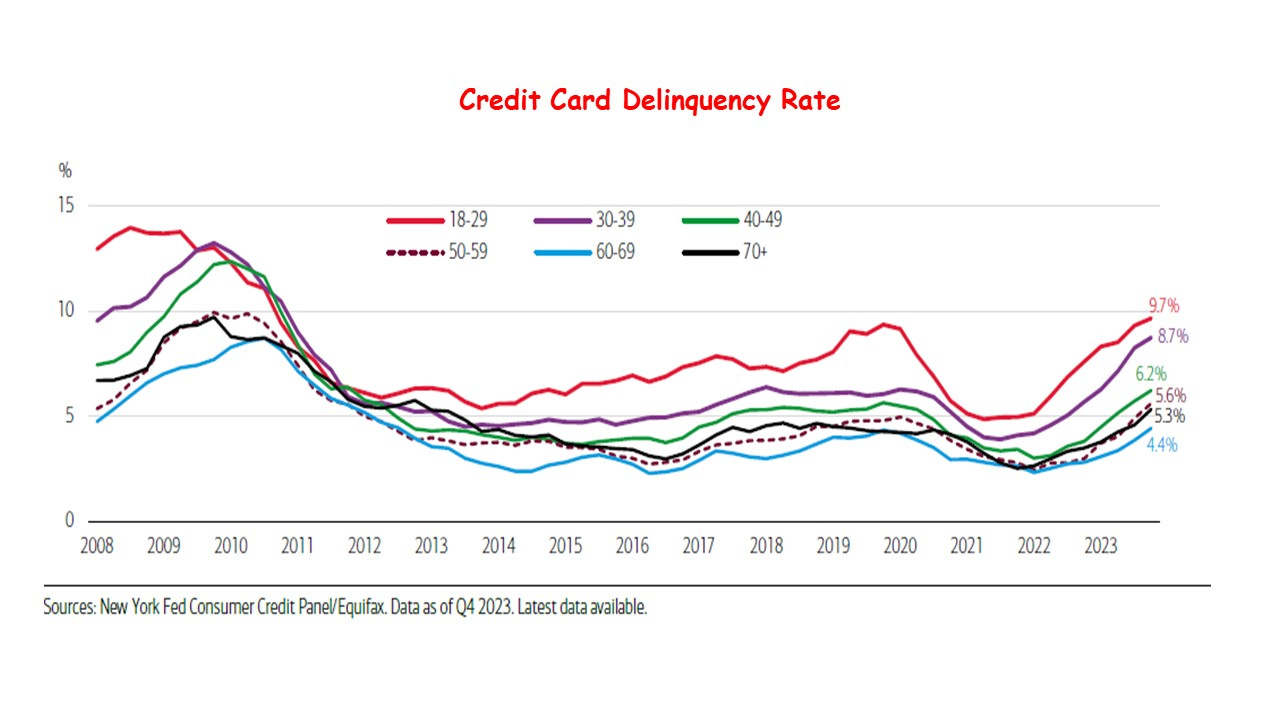

However, there are worrisome tailwinds. Consumer confidence, particularly among younger generations such as Gen Z, has declined due to limited job opportunities and decreasing prospects for homeownership. The national savings rate has also plummeted from 32% in April 2020 to 3.2% in March, leading many consumers to rely more on credit cards. Consequently, credit card debt has escalated to $1.13 trillion, with delinquencies increasing, especially among those under 40.

Although the inflation rate has moderated over the past two years, the cost of living has risen significantly. For example, a grocery basket that cost $100.30 in 2019 now costs $136.89. Prices for items like eggs and coffee have also increased substantially.

On the other hand, deflationary pressures from China continue to mitigate price increases. China’s excess capacity has led to lower prices for steel, solar panels, lithium batteries, and electronic goods. However, the U.S. and EU are set to tighten trade restrictions on Chinese goods, which may influence these trends.

Considering both headwinds and tailwinds, the economic outlook has more positives than negatives. The ongoing "rolling recession" is expected to slow growth but result in a soft landing. The inflation rate, despite being hampered by the "last mile" challenge, is gradually progressing toward the Federal Reserve's 2% target. Although delayed, the central bank is likely to start reducing interest rates in the latter half of the year as economic growth moderates and inflation decelerates. After some necessary adjustments, the stock market should resume its upward trend.

Top of Form

Bottom of Form