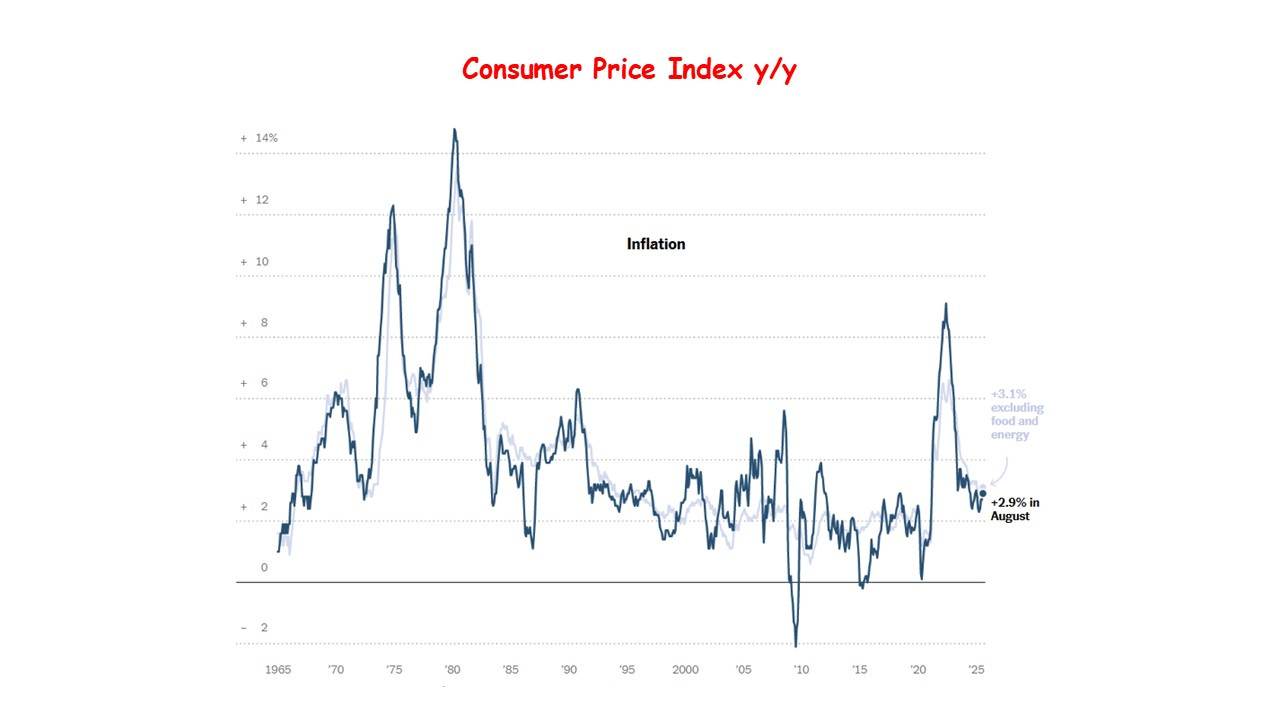

Inflation Accelerates in August

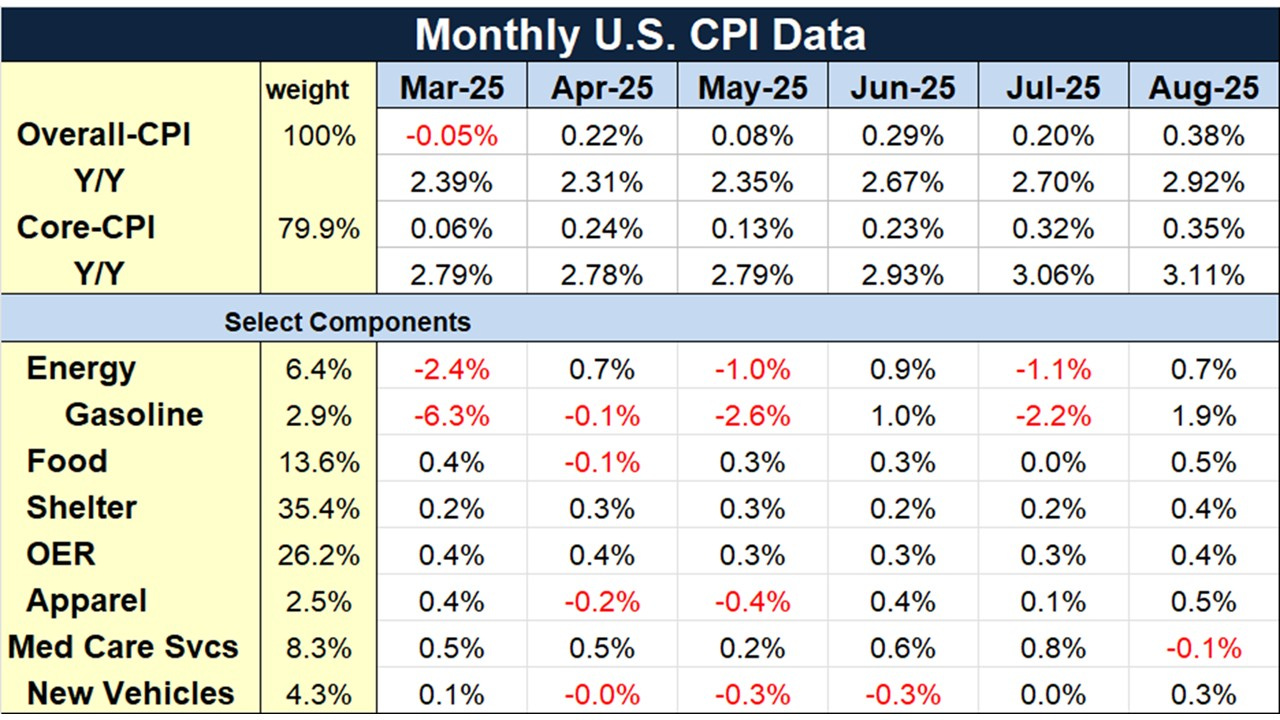

In August, the CPI accelerated to 2.9 percent annual pace from the 2.7 percent during June and July. The monthly rate during the month also sped up to 0.4 percent from 0.2 percent in July. The core rate, excluding food and energy rose 3.1 percent from a year ago and 0.3 percent for the month. The prices of gasoline, airfare, and new and used cars rose while medical care, recreation and communication fell.

Some of the inflationary pressures now emerging in the U.S. economy are best understood as short-term shocks, some driven by tariffs. Economists often liken this to a mouse moving through a snake: the impact is visible while it passes through, but it eventually fades. Household goods such as furniture, appliances, clothing, and electronics have all seen noticeable price increases as tariff costs filter into retail shelves. New vehicle prices have begun to rise, as automakers which absorbed earlier tariff costs, are raising prices as the growing burden of tariffs on steel, aluminum, and imported parts mounts.

Food prices also reflect this short-term pressure. After being flat in July, grocery costs moved higher in August. Restaurant prices are climbing as well, partly because immigration restrictions are tightening the labor supply in food services. Since food is one of the most immediate and visible household expenses, these increases carry outsized weight in shaping public perception of inflation. Yet, like other tariff-driven categories, they represent temporary shocks that tend to subside once the initial cost adjustments move through supply chains.

Alongside these transitory influences, longer-term forces are working in the opposite direction. Shelter costs remain one of the largest components of the Consumer Price Index, still rising at a monthly pace of roughly 0.4 percent. However, forward-looking measures, including new lease agreements, suggest housing inflation is moderating. As these trends work their way into the data, shelter is likely to exert less upward pressure on overall inflation than it did in 2022 and 2023.

More significantly, the labor market is losing momentum. The August jobs report showed only 22,000 positions added, while the unemployment rate rose to 4.3 percent, the highest level since 2021. In addition, the 2024 job gains were sharply revised down earlier making the employment picture even weaker. Workers are increasingly aware of the shift: the New York Fed’s Survey of Consumer Expectations found the perceived probability of finding a new job has dropped. This erosion in confidence suggests slower wage growth ahead, which should ease service-sector inflation in the months to come.

This is the last inflation report before next week’s FOMC meeting at the Federal Reserve. Even though a September cut is a fait a compli, the future trend looks less certain. The interaction of rising inflation and a softening employment creates a difficult policy dilemma for the Federal Reserve. On one hand, tariff-driven increases in goods prices are keeping headline inflation higher than its target rate of 2 percent, raising concerns about credibility in the inflation fight. On the other hand, the weakening labor demand points toward a disinflationary path that could deepen if interest rates remain restrictive. Cutting rates too quickly risks embedding tariff-driven inflation, while delaying cuts risks amplifying unemployment and weakening household confidence further.