Sung Won Sohn Ph. D, Professor of Finance and Economics

Loyola Marymount University and Chief Economist of SS Economics

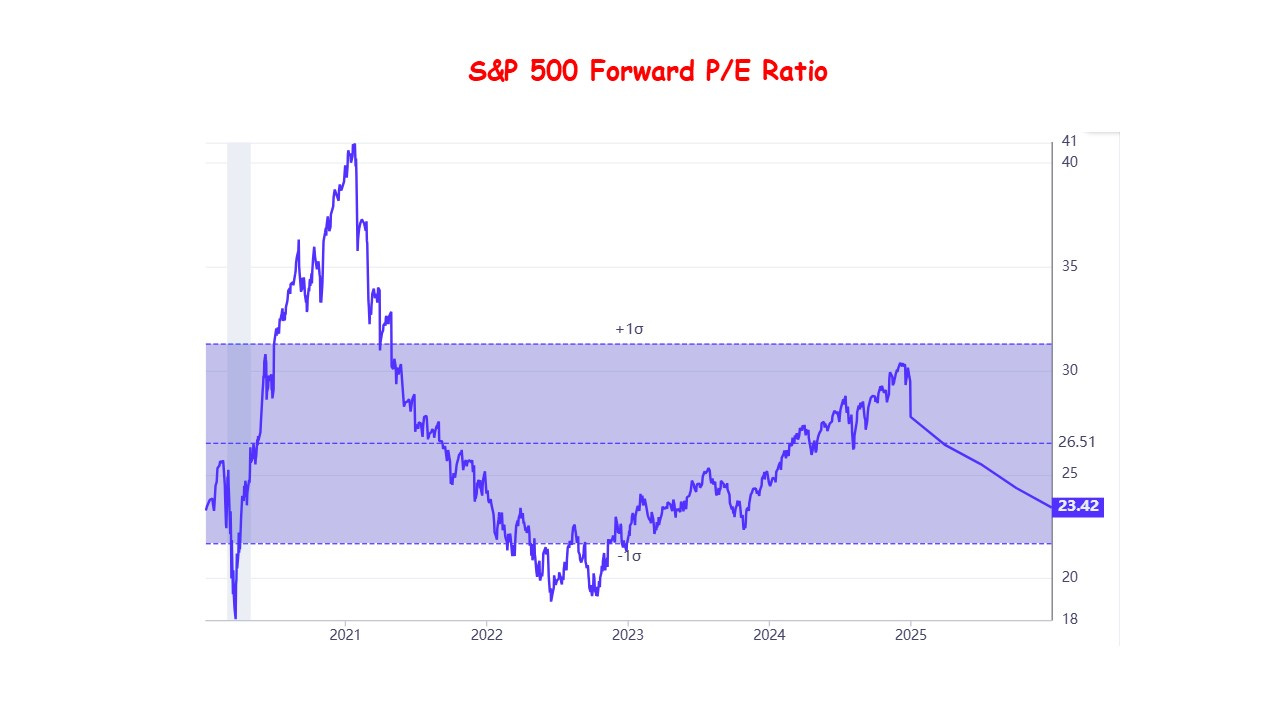

Foreign investment played a pivotal role in shaping U.S. financial markets in 2024. The year witnessed a significant surge in the stock market, driven primarily by an increase in valuations, as the price-to-earnings (P/E) ratio climbed to very high levels. While robust corporate earnings also contributed to the market rally, the upward momentum was in part fueled by the confidence and liquidity brought by foreign investors. However, as 2025 unfolds, the outlook for foreign investment appears less promising, particularly amid the specter of a potential trade war, a weakening U.S. dollar, and growing fiscal challenges.

Foreign Investment in 2024: A Key Source of Demand

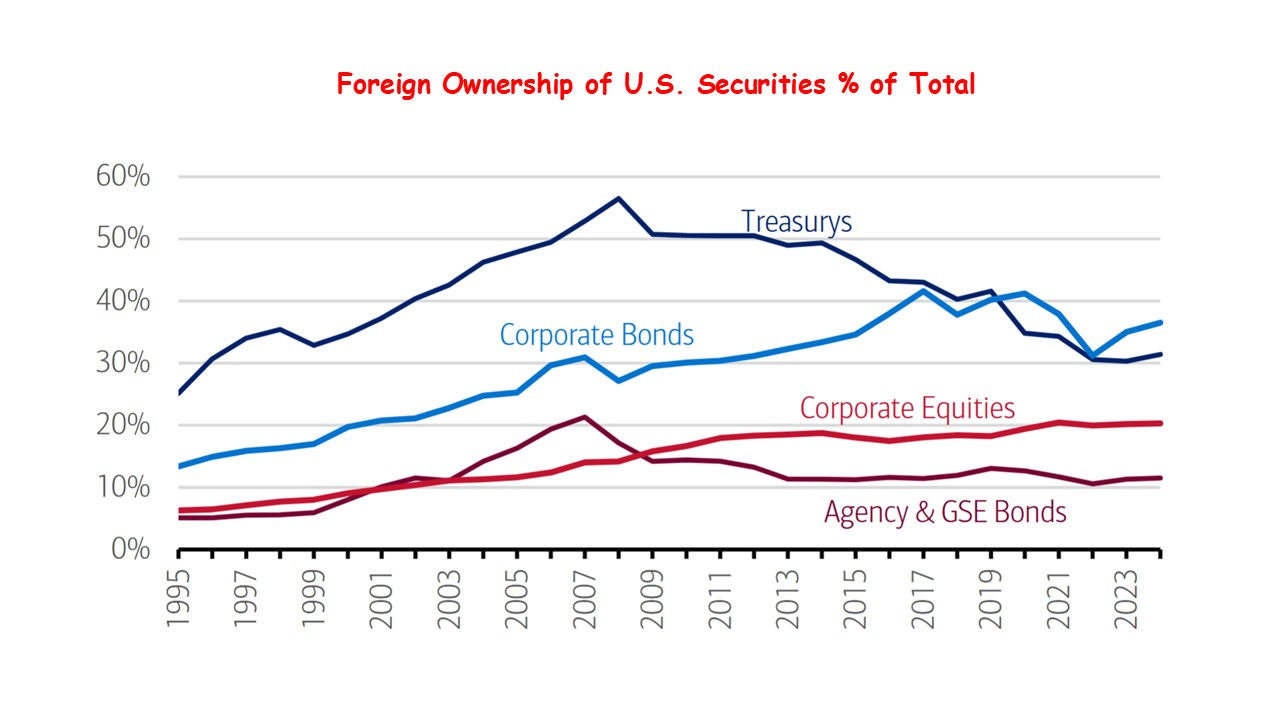

Data from the Federal Reserve Board underscores the remarkable role of foreign capital in 2024. Foreign ownership of U.S. stocks, bonds, and Treasuries surged 23.3%, reaching a record high of $30.7 trillion in the third quarter. This influx of foreign money bolstered both equity and fixed-income markets. In equities, the increase in valuation multiples was a testament to the confidence that global investors placed in the U.S. economy and its financial assets. Similarly, foreign demand for bonds helped limit increases in Treasury yields for much of the year, despite the backdrop of rising government deficits.

However, the elevated valuations in the stock market raise questions about sustainability. The P/E expansion, while advantageous in 2024, is unlikely to persist at the same pace in 2025, especially if foreign investment recedes. As valuations stabilize or contract, the stock market will need to rely more heavily on earnings growth—an uncertain prospect given the economic headwinds.

The 2025 Outlook: Clouds on the Horizon

Several factors cast a shadow over the continued strength of foreign investment in 2025. Chief among them is the potential eruption of a trade war. The imposition of U.S. tariffs and retaliatory measures from trading partners could deter foreign capital inflows. Historically, a strong U.S. dollar has been a magnet for foreign investment, but the dollar’s value could weaken in the event of trade disputes, reducing the appeal of U.S. assets.

In addition, the U.S. federal budget deficit, which has ballooned to trillions of dollars annually, poses a structural challenge. Financing this deficit requires robust demand for U.S. Treasury securities. However, foreign investors, particularly China, have been reducing their Treasury holdings. This trend has persisted since 2008, driven in part by portfolio diversification strategies. If trade tensions escalate, China could accelerate its divestment of U.S. Treasuries, putting upward pressure on yields despite potential Federal Reserve rate cuts.

Japan, another major holder of U.S. government securities, has also shown limited appetite for increasing its Treasury holdings in recent years. The diminishing role of foreign buyers in the Treasury market could have significant implications for U.S. interest rates, borrowing costs including mortgage rates, and the broader economy.

Implications for Treasury Yields

The rise in U.S. Treasury yields in 2024, despite Federal Reserve rate cuts, highlights the complex dynamics at play. Domestic factors such as healthy economic activity and inflation expectations contributed to the uptick in yields. However, the reduced pace of foreign purchases of Treasuries likely amplified the increase. In 2025, the interplay between Federal Reserve policy and foreign investment will be crucial. If foreign demand falters, Treasury yields could remain elevated, driving up borrowing costs for consumers and businesses alike.

The role of China in this equation is particularly significant. As the largest foreign holder of U.S. Treasuries, China’s actions have an outsized impact on the market. A rapid divestment of its holdings in response to geopolitical tensions or trade disputes could disrupt financial markets, keeping yields high and complicating the Federal Reserve’s efforts to manage monetary policy.

Conclusion

While foreign investment was a vital source of demand in U.S. financial markets in 2024, the outlook for 2025 is fraught with uncertainties. Trade tensions, a weakening dollar, and the continued reduction of foreign holdings of U.S. Treasuries, particularly by China, present significant risks. These factors, combined with the growing fiscal deficit, could exert upward pressure on Treasury yields, even in the face of Federal Reserve rate cuts. As the global economic landscape evolves, the U.S. must navigate these challenges carefully to maintain the stability and attractiveness of its financial markets.