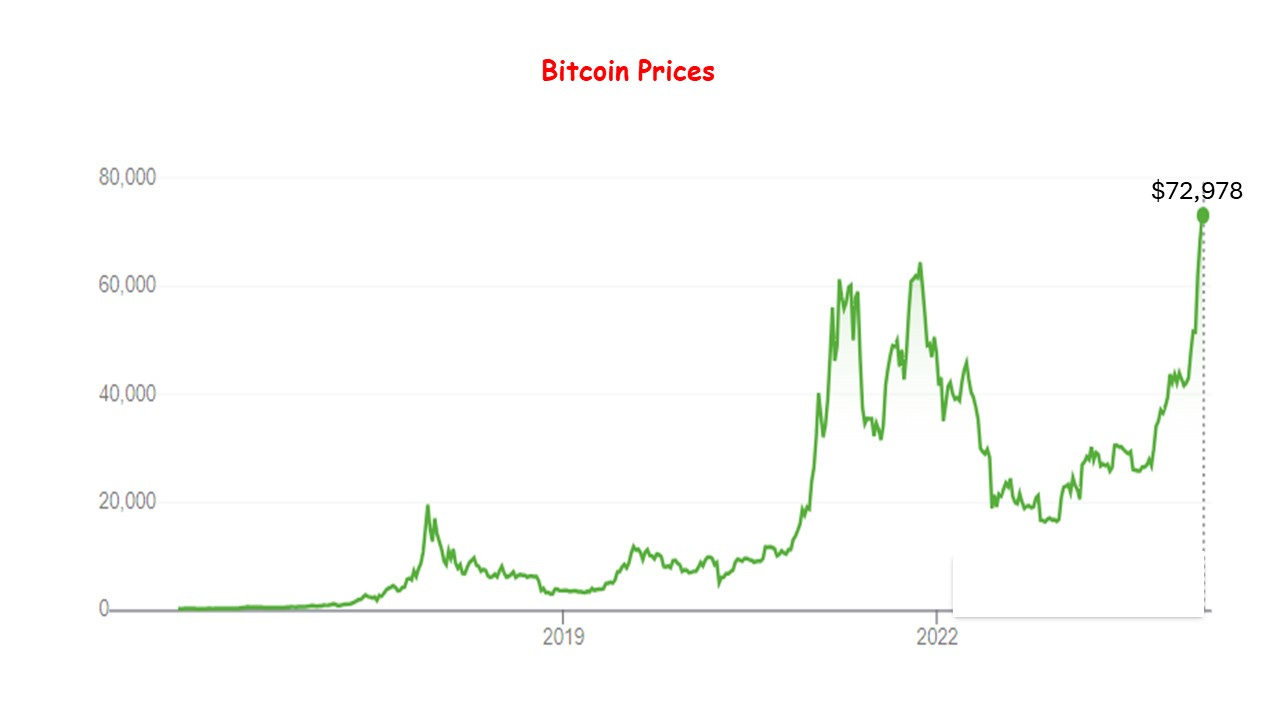

Time to Buy Bitcoin?

Why prices have been soaring

Bitcoin prices have soared recently due to a combination of factors that play a significant role in its valuation. Understanding these factors provides insight into the complex dynamics of cryptocurrency markets.

Bitcoin is designed with a finite supply. The maximum number of bitcoins ever mined is capped at 21 million. This scarcity is coded into the Bitcoin price. Over 18 million bitcoins have already been mined, leaving fewer than 3 million to be introduced into circulation.

Also, the rate at which bitcoins are mined is predetermined by the Bitcoin protocol. Approximately every 10 minutes, a new block is added to the blockchain, and the miner who solves the block's cryptographic puzzle is rewarded with newly minted bitcoins. This reward halves approximately every four years in an event known as the "halving". Initially, the reward was 50 bitcoins per block; it has since halved several times. Today, the reward is 6.25 bitcoins per block, and it will halve again to 3.125 bitcoins at the next halving event. This decreasing supply of new bitcoins entering the market exerts upward pressure on the price.

In the meantime, the demand for Bitcoin has been increasing from various sectors, including institutional investors, retail investors, and companies looking to hold Bitcoin in their treasury. Regulatory clarity has enhanced investor confidence in cryptocurrency. The government regulators have allowed Exchange-Traded Funds (ETFs) on cryptocurrency to operate. A broader base of investors can have exposure to Bitcoin without having to hold the asset directly. Currently, this demand from ETFs and institutional investors exceeds the new bitcoins being mined, contributing to price increases.

Improvements in blockchain technology, increasing acceptance of Bitcoin as a payment method by merchants and service providers, have helped.

As more people use and hold Bitcoin, its value increases due to the network effect. The utility, security, and perceived value of Bitcoin grow as the number of users and transactions on the network increases.

There are other reasons behind the jump in the price of Bitcoin. Global economic uncertainties, inflation fears, and the search for "safe-haven" assets can drive investors towards Bitcoin as a hedge against traditional financial systems and fiat currency devaluation. For example, Nigeria recently decided to float its currency naira which has lost about a third of its value. Many Nigerian investors flocked to cryptocurrency to park their money.

As Bitcoin prices surge, the media attention and hype around cryptocurrencies, especially on Bitcoin, has grown. This publicity generates a Fear of Missing Out (FOMO) among potential investors who see Bitcoin's price increases and don't want to miss out on potential gains. This psychological factor drives more people to buy Bitcoin, further pushing up prices.

The interplay of these factors creates a dynamic and sometimes volatile market for Bitcoin. It's essential to understand that while these factors can drive prices up, they can also lead to corrections as market sentiments change. Bitcoin, like all investments, carries risks alongside its potential rewards, and its market is influenced by a wide range of factors beyond those listed here.