Troubles at ESG Investing

The once-dominant enthusiasm for Environmental, Social, and Governance (ESG) funds in the investment community is now facing numerous challenges. Initially, these funds surged in popularity due to their promise of sustainable and responsible investment.

However, their performance has not lived up to expectations. Achieving net-zero emissions, a key goal of many ESG initiatives, has proven to be less profitable than anticipated. Detroit has scaled back its electric vehicle (EV) plans, and among automakers, only Tesla has managed to turn a profit in this sector. The rapid evolution of technology poses a risk to current green energy investments, which might become obsolete in the future.

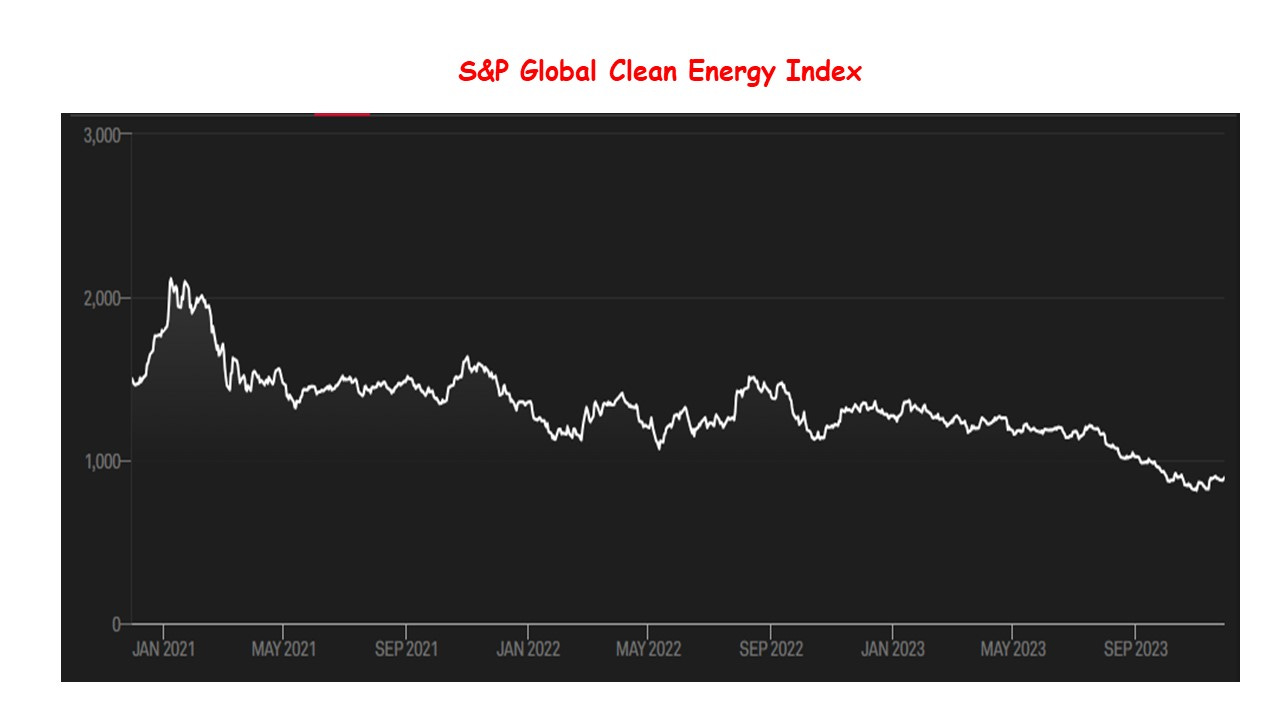

This downtrend in ESG investing is reflected in the 30% drop in the S&P Global Clean Energy Index this year. There is a significant decrease in the US market for ESG investing, contributing to a global downturn. In response, some investment managers are distancing themselves from the ESG label, with eight funds from a large financial institution and others removing the "sustainable" tag from their names in the first half of 2023.

Regulatory pressures are also increasing. The U.S. Securities and Exchange Commission (SEC) has enacted new regulations that require funds bearing names suggestive of ESG or sustainability-focused investment to allocate at least 80% of their assets in line with these themes.

The rule also mandates that fund names be clear and understandable. This measure is aimed at preventing misleading marketing about ESG commitments and ensuring that funds' investment strategies align closely with their stated goals, enhancing transparency and accountability.

These developments—a mix of weaker performance, investor retreat, the removal of "sustainable" labels, and heightened regulatory scrutiny—indicate a significant shift in the ESG sector. The trend that once saw booming growth is now undergoing a reality check, influenced by changing market dynamics and regulatory environments.

However, the challenges facing the ESG funds do not overshadow the long-term positive outlook for green energy investment, which is vital for economic growth. The sector promises extensive job creation across various domains, from research and development to manufacturing and installation. Moreover, renewable energy, once operational, tends to have lower maintenance and operational costs than traditional fossil fuels, offering long-term cost savings and economic benefits.

From a strategic perspective, investments in carbon reduction and the pursuit of net-zero emissions are not just environmental goals but also crucial economic decisions. These investments herald a future where economic growth and sustainability coexist, fostering innovation and enhancing national energy security and independence. Thus, the transition to a greener future is not only a moral imperative but also a wise economic strategy, leading to a healthier and more prosperous world.